FIRE (Financial Independence Retire Early) means different things to different people. In short, though, it is about saving & investing enough money, usually regularly, to be able to retire early and live off your investments.

Table of Contents

Why don’t more people achieve FIRE

If you asked the vast majority of people if they would like to work until they are well into their 60s or would they like to achieve financial freedom and retire early, I’m pretty sure 99% of people would choose the retire early option. So why don’t they?:

Lack of financial savvy & planning

This is a bit of a hobby horse for me and one of the reasons for creating this blog is to try and get more people to think about FIRE and educate themselves a bit.

So if you’re reading this, then congratulations, you are a big step ahead of most people.

I have worked in Financial Services for decades. I qualified as a Financial Advisor in my 20’s and I have interviewed thousands of people about their finances. My key takeaway from all of this is that the level of financial education/savvy in the UK is appalling.

It doesn’t matter how much you earn, your level of education, what you do for a job etc. Most people suck when it comes to understanding personal finance and investing.

So the number one reason most people can’t retire early is lack of knowledge and financial planning.

Materialism & mindset

Number two, is people get sucked into the materialist mindset or keeping up with the Jones’s. People stretch themselves to get a bigger house, a better car, eat out a lot, go on 3 foreign holidays a year etc. etc.

Don’t get me wrong, FIRE should not be about sacrificing enjoying life whilst you are young. It’s about balance. If you spend all your disposable earnings on materialistic things, you have no money to invest for the future.

Lack of disposable income

Number three is, that even if they have the required knowledge, they simply don’t earn enough for it to be a realistic option. FIRE is not the sole preserve of the very well paid but there is a realistic threshold of earnings. You need to have disposable income to invest.

If you earn £30k p/a, have a non-working partner and two kids to look after then you won’t know what disposable income is, because you don’t have any. Everything you earn goes straight out the door on essentials. Doesn’t matter how frugal you are, FIRE is most likely an unrealistic aim.

Is FIRE only achievable by people who earn a lot of money

It is certainly easier to achieve FIRE if you earn a lot of money, but people can and do achieve it on career average modest salaries. As I mentioned above, the biggest hurdle to achieving FIRE is not so much what you earn but having disposable income that you invest regularly and wisely.

Sure, if you earn £150k+ in a cushy corporate job with 15% employer-matched pension contributions then it’s easier for you to achieve FIRE than someone who earns £40k with a lousy employer pension scheme. But it’s feasible at both ends of the spectrum.

Do I have to live an ultra-frugal lifestyle to achieve FIRE

When people first come across FIRE, me included, you read the famous stories of people who retired in their 30’s. These ‘Fire Extremists’ achieved this by earning good money and investing it all, whilst living like a Trappist monk.

Don’t be put off by these extremist stories, the vast majority of people following the FIRE methodology are not like this. We keep our spending in check but enjoy life whilst saving hard for the future.

A lot of the articles I read online from large publications are just putting out puff pieces that grab headlines, talk about saving 70%+ of your income etc. but this simply isn’t the case for most of us.

So, yes, you do need to keep your spending in check. The more you can save to invest the quicker you’ll achieve FIRE, but there is no point in any of this if you aren’t enjoying life in the here and now. Balance vs deferred gratification is the key.

How do I invest for FIRE

The most common and recommended investment strategy for FIRE is to use tax-wrapped accounts (Pension & ISA’s in the UK) to regularly invest in a well-diversified low-cost index tracking fund.

We are lucky in the UK because Pensions and ISA’s are very tax-efficient ways of saving money and they are more generous than those offered in most other countries.

Pension contributions are free of tax on the way in and if you are employed your employer contributes as well. You can save up to £60,000 per year into your pension, assuming you have enough pensionable earnings.

With ISA’s, there is no tax relief on the way in (except for LISA’s, kind of) but once the money is in an ISA it is then free of all tax. So you can draw an income from it without paying any income tax, capital gains tax etc. etc. You can save £20,000 per year into a Stocks & Shares ISA.

What is the FIRE movement

The terms FIRE and Financial Independence Retire Early were originally coined in a book called Your Money or Your Life, published in 1992. Since then FIRE has become the go-to phrase used by people who are seeking to become financially independent and retire early (especially very early i.e. under 50).

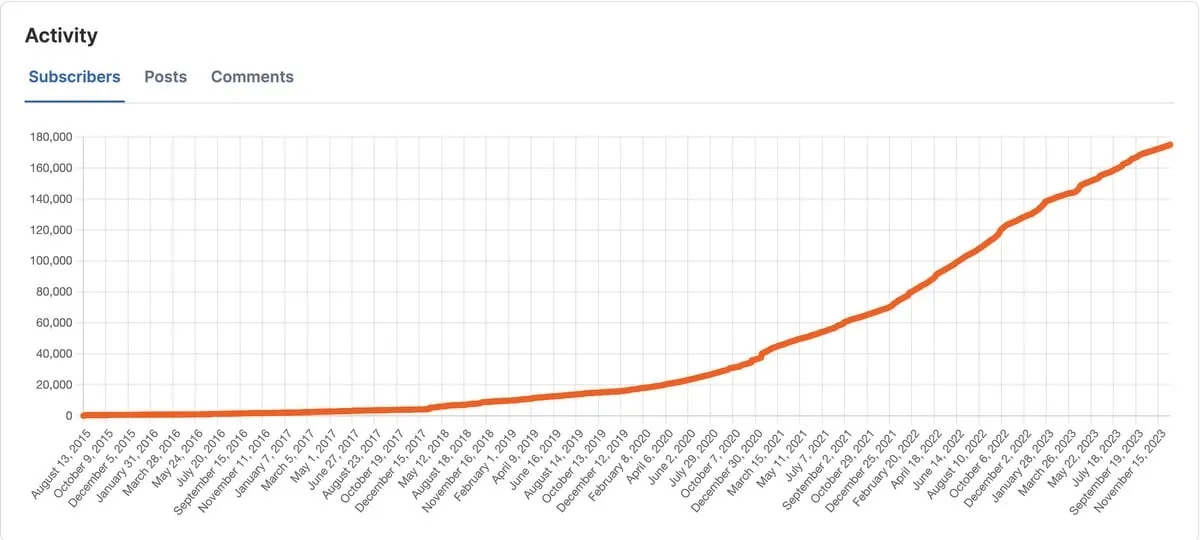

That little bit of history to one side, the best thing about this burgeoning FIRE community is the ability to chat with others pursuing the same dream and get ideas and advice. It is undoubtedly bigger in the US than in the UK but we aren’t far behind. The FIREUK subReddit has 188k members and the community is an active one. You can see the growth in the popularity of FIRE, just by looking at the growth of that subreddit.

Growth in Popularity of FIRE in the UK

Using the number of members of the FIREUK SubReddit

There are FIRE meetups in various cities, where you can meet like-minded people in person. There’s one here in Edinburgh where I live and I know there is one in London and there are dozens in the US.

I find people in the UK are generally very reluctant to talk about money, even if they are close friends. Try talking about FIRE with your friends and you’ll likely get a very muted and disinterested response. And I definitely wouldn’t say to your friends ‘Hey, I just hit £1m in my SIPP’ expecting them to congratulate you. So having places you can go and meet like-minded people, be it online or in person, to chat about FIRE is really useful and I have personally learnt a lot from the Reddit FIRE community.

How much money do I need for FIRE

There is good news and bad news here.

Let’s get the bad news out of the way first – you need a serious amount of money by most people’s standards.

Then there’s the good news. If you start early, with the right plan, getting to these seemingly astronomical amounts of money is not quite as hard as you might think due to the magic of compound growth.

How much is a ‘Serious amount of money’

There is a generally accepted ballpark way of working out how much you need to FIRE and it is called the Safe Withdrawal Rate. It is based on a study carried out in the ’90’s which worked out that given the long-term performance of the stock market and historical rates of inflation you could take 4% per year out of your investments over 30 years and you’d very likely not run out of money. Or, to do the maths another way, you need 25x your annual expenditure in investments.

Whilst the 4% Safe Withdrawal Rate concept has its flaws and is not to be taken as some kind of unbreakable rule, it is useful as a simple way of calculating the sort of money you need.

If you need/want £30k per annum in retirement, then using the SWR figures you need 30×25 = £750k. If that £30k figure is net of tax then you need even more, close to £1m.

There is even worse news if you are retiring early and therefore hoping to have more than 30 years of retirement. The 4% figure becomes 3.5% or even 3% depending on your age, which pushes the amount required even higher.

If you want to know more about how much you need to FIRE and some of the things to consider, you may want to read another article of mine How Much Do I Need To Retire At 55.

The magic of compound growth

Let’s use a figure of £750k as the amount you need to have saved before you can retire early (this will be more than some need and too little for others). That is one hell of a lot of money and probably puts most people off the whole FIRE idea straight away, but don’t be so quickly disheartened. Compound growth and time will help you massively.

If you save £630 per month and invest it in a low-cost global index tracker, and do so consistently for 30 years and factor in inflation, then you will come out with around the required £750k in today’s money. (to get to these numbers I used 8% p/a market return and 3% inflation, which is the long-term average for both)

£630 per month is still a lot of money, especially doing it consistently over 30 years. But it certainly seems more feasible than just saying £750k. And remember that some of this will come from your employer in terms of matched pension contributions.

30 years sound way too long to get to £750k? How about 16 years – If you are fortunate enough to be able to save £2k per month, you can hit £750k in just over 16 years.

What are the different types of FIRE

There is another good piece of news and that is for most of us, FIRE is not about saving for 30 years and then suddenly hanging up your boots and completely retiring. There are several different types of FIRE (Lean FIRE, Chubby FIRE, Fat FIRE etc. that I have covered previously) but a common one for many of us is what’s called Barista FIRE.

Barista FIRE is the term people use to describe moving to part-time/less stressful work as part of their transition to early retirement. Either to supplement the income from your investments or to cover all of your living expenses. You’re earning a lot less but you don’t need to actively contribute to your investment pot.

Barista FIRE can make a massive difference to how early you can downshift and escape the rat race.