As you explore the FIRE movement you will come across terms such as Lean FIRE, Chubby FIRE, Fat FIRE etc. But what do these terms actually mean?

To my mind there are two ways of defining these terms, the first is the more subjective ‘what kind of lifestyle does my FIRE income allow me to have’ and then a more objective definition which is hard numbers based.

I also think, that whilst the Financial Independence movement has come up with catchy definitions such as Fat FIRE, you need to be careful not to get hung up on these terms or where you are on some financial scale relative to others.

At the end of the day, all that really counts is for you to work out what kind of income you need to provide the lifestyle you want balanced against how long you are willing to work to get to that point.

What do the different FIRE definitions mean in terms of lifestyle

Lean FIRE Definition

Lean FIRE – Means retiring early with an expected income under the median income in your area/country. So you are going to be living a pretty minimal/frugal lifestyle with limited budget for luxuries such as holidays, cars, eating out etc.

FIRE Definition

FIRE – Means retiring with an expected income around the median in your area/country. This means you’ll be living a moderate lifestyle e.g. a foreign holiday each year, eating out a few times a month etc.

Chubby FIRE Definition

Chubby FIRE – Means retiring early with an income above the median. You’ll be living a comfortable lifestyle.

Fat FIRE Definition

Fat FIRE – Means retiring early with an income in the top percentiles of household income. At this level, you will be able to afford a very comfortable lifestyle with few realistic limits on what you can afford to do. We aren’t talking superyacht territory here, but numerous foreign holidays a year, eating out often, a new car every few years etc.

One obvious question/debate from the above is what exactly do we mean by ‘retire early’? Technically speaking if you are retiring before the state pension age, which is currently 67, then that is retiring early. However, I don’t think most of us would see retiring at 66 as early retirement.

From my personal perspective I’m planning to retire before I’m 55 (I’m 50 now), but you may have a very different age in mind. I’ll cover more on how to factor your chosen retirement age into the equation when we get into the numbers.

Give me the numbers

Ok, so we’ve looked at the type of lifestyle you can have in your retirement but what does that actually mean in terms of hard cash.

Pensions and Lifetime Savings Association – Retirement Living Standards Study

The Pensions and Lifetime Savings Association regularly publish a report based on research carried out by Loughborough University. This looks at what type of lifestyle a single person or a couple can have in retirement based on what they will earn.

In short, these are the numbers they have come up with:

Three things to note about the above numbers from a FIRE perspective:

- The numbers assume you have paid off your mortgage and are not paying rent

- They include state pension i.e. if you look at the minimum income a single person needs of £12,800. £10,600 of this could come from a full state pension

- They are post-tax e.g. are net income after any tax has been deducted

It is well worth reading through the full Retirement Living Standards Study as they go into a lot of detail about how they arrive at the numbers, what size pension you need to generate the income levels etc.

What the different FIRE definitions mean in terms of size of investment pot

OK, so now let’s get into the meat of this and get into how much money you need to have invested and how that is affected by your retirement age.

How Retirement Age Affects the Safe Withdrawal Rate

Before using the following tables we need to have a look at what is the most suitable Safe Withdrawal Rate to use based on the age at which you want to FIRE.

I am not going to go into great detail on SWRs because Karsten over at https://earlyretirementnow.com has researched and written extensively about it on his blog, so I’d urge you to read through that if you need more detail.

I’d also point out at this stage that I am only using the Safe Withdrawal Rate approach because it is a very simple way of doing your FIRE calculations. I am not advocating that SWR is the best approach to use when you actually start the drawdown/decumulation phase of FIRE (again Kartsen has a load of info on different approaches and their pros and cons).

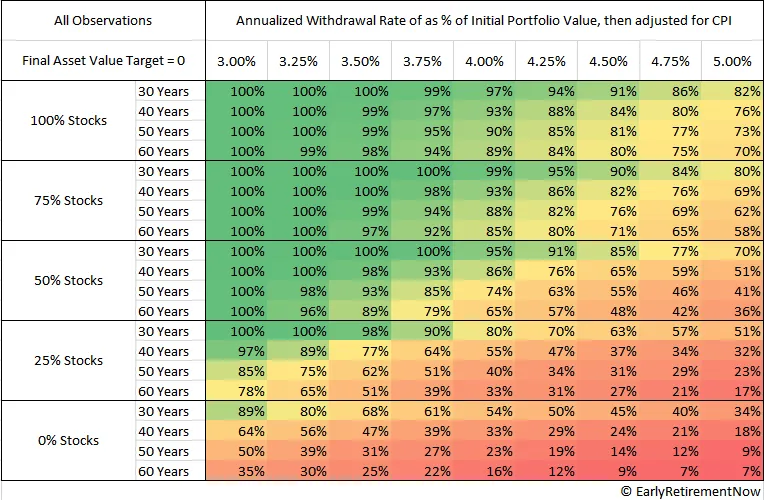

On Karsten’s site he has the following table which shows you how your retirement length and your asset allocation impact the SWR to use in your calculations.

Based on the data above and your own approach to risk use an appropriate Safe Withdrawal Rate for you when looking at the tables below.

For my own purposes, I am 50 and MAFF is 45 and we plan to FIRE in the next 5 years. So I’m allowing for a 40 year retirement length (which allows for MAFF living until 90).

I also intend to stay 100% equities for reasons that I have touched on before (in short, because we both have a Defined Benefit Pension which will pay us a guaranteed income for life, so, in reality, we are the equivalent of circa 50% equities). Most of you reading this are probably planning to be 50%-75% equities when in FIRE.

So for my calculations, I use a 3.5% Safe Withdrawal Rate, which according to Kirsten’s data has a 99% success rate i.e. there is only a 1% chance we will run out of money. That is pretty conservative to my mind and you’ll also notice from the table that even if MAFF lives to be 100 (50 year retirement) the risk stays the same.

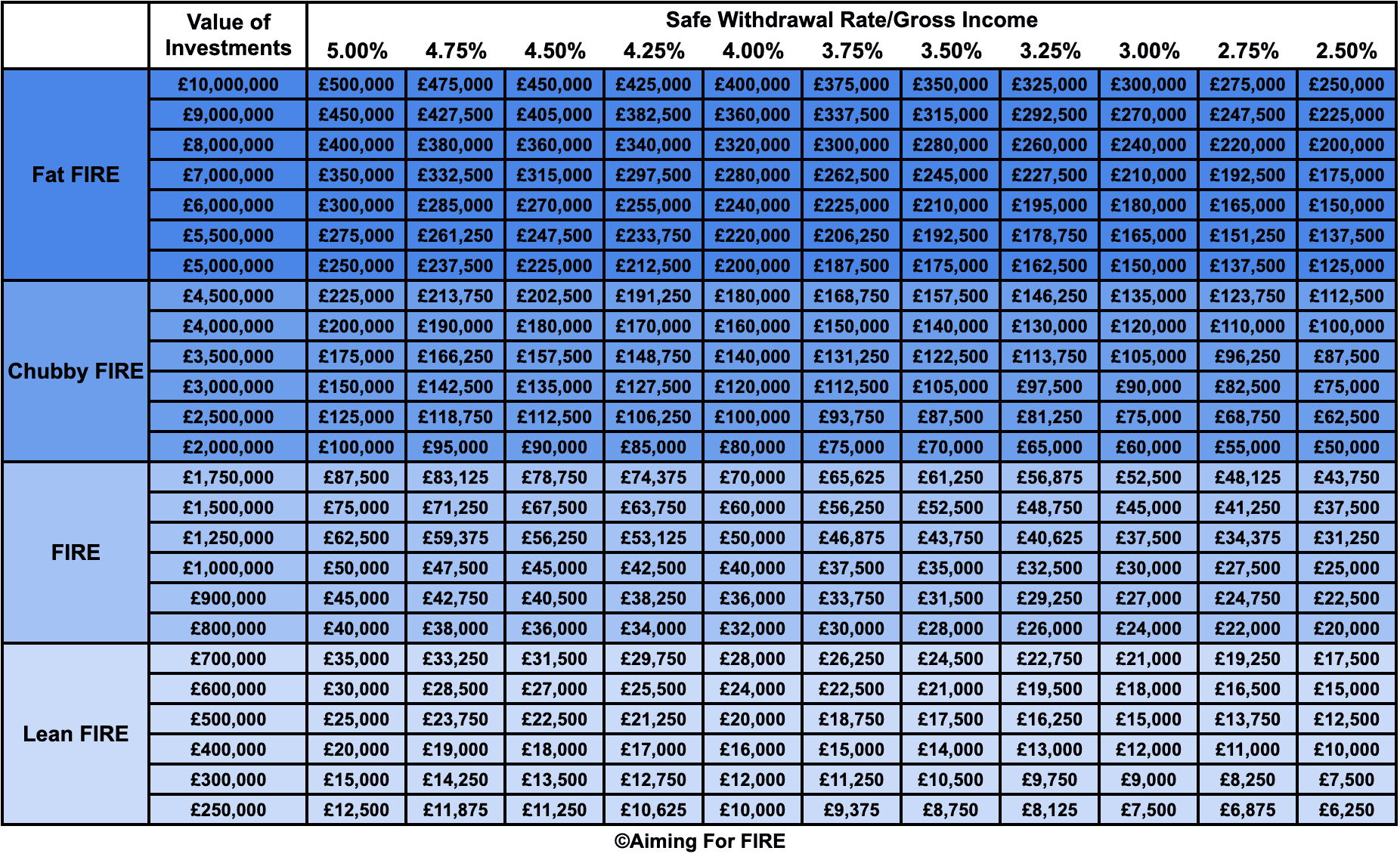

FIRE Types by Value of Investments

After all that preamble, here’s my take on what the different types of FIRE amount to in terms of how much money you need.

- Lean FIRE – somewhere between £250k-£700k

- FIRE – between £800k-£1.75m

- Chubby FIRE – £2m-£4.5m

- Fat FIRE – £5m-£10m

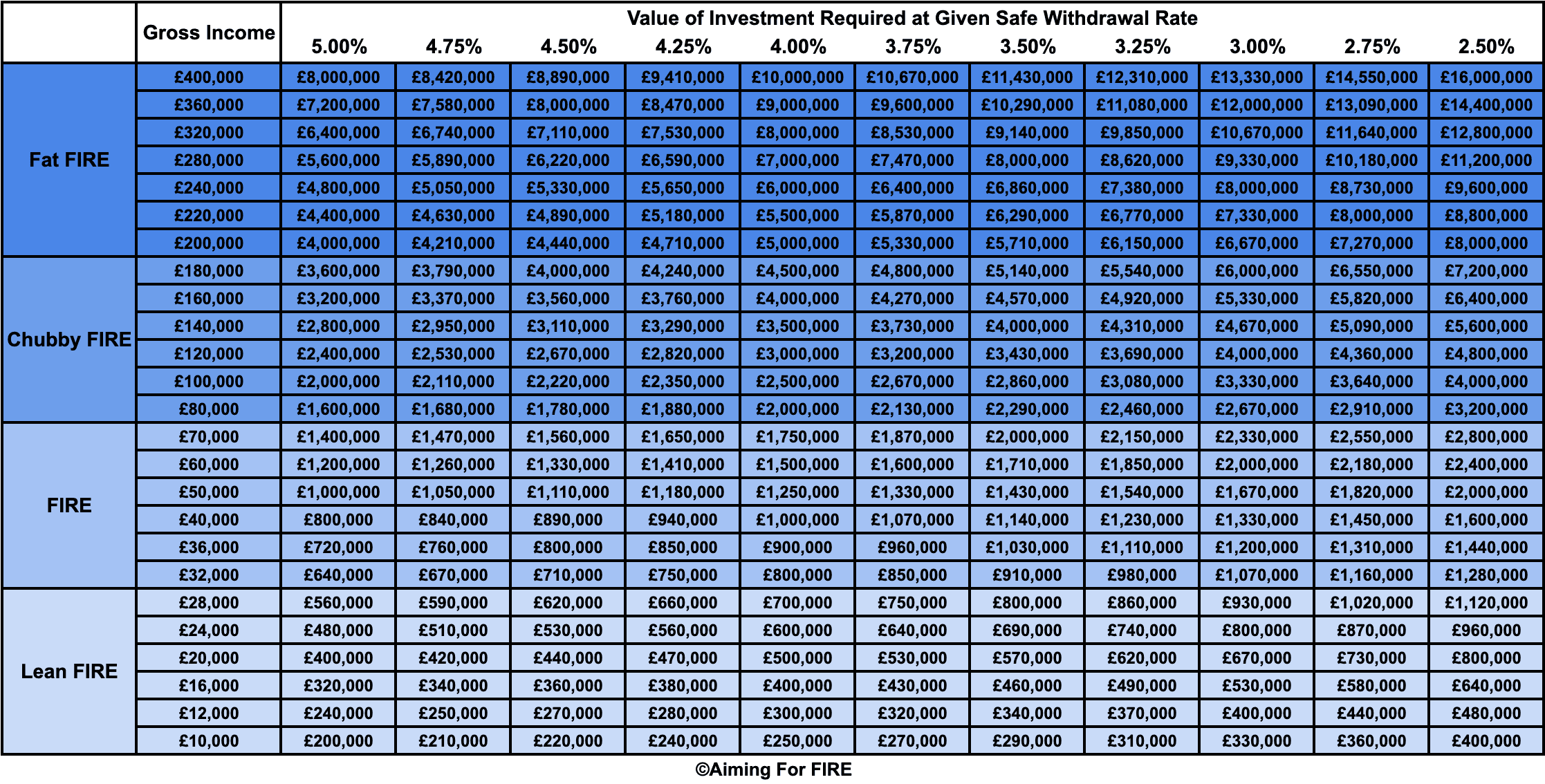

FIRE Types by Gross Income

Another, and arguably more useful, way of looking at the different meanings of FIRE is by gross income requirement.

- Lean FIRE number – somewhere between £10k-£28k per annum

- FIRE number – between £32k-£70k pa

- Chubby FIRE number – £80k-£180k pa

- Fat FIRE number – £200k-400k pa

I posted both of the above tables on the FIREUK and FatFIRE sub-Reddits to get people’s thoughts and input on the numbers and whilst a few felt the Chubby FIRE & Fat FIRE numbers were a bit high, the general consensus (across about 160 commenters) was that my numbers and how I’ve banded the definitions felt about right.

Caveats/Points to note:

- Numbers exclude any debts you need to service e.g. mortgage

- They are per person but you certainly don’t need to double them for a couple

- Home equity is excluded

- It does not make any investment assumptions e.g. 100% vs 50% equities (but clearly it needs to be invested appropriately to achieve your chosen SWR percentage)

- The numbers are gross of tax. I’ve decided to do it that way as there are just too many variations depending on how your investments are structured e.g. all your money could be in ISAs and therefore totally tax free

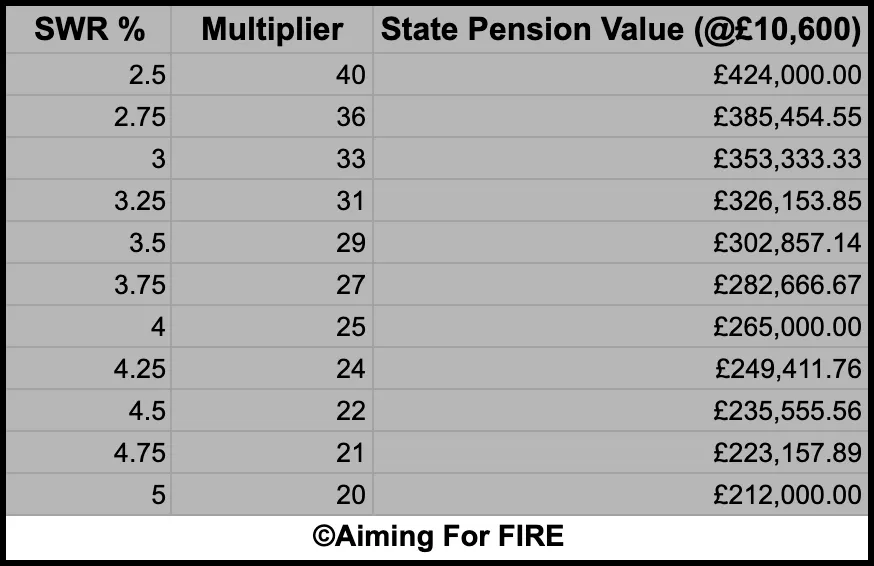

How do I factor State Pension into my FIRE numbers

I tend to ignore the state pension in my numbers simply because I don’t trust the government not to take it away at some point via means-testing or some other way.

But if you do feel comfortable including it (or you’re screwed without it) then you can deduct it from the numbers.

For example, if you are using 3% as your Safe Withdrawal Rate number then you would take £10,600 (the current full state pension amount) and multiply it by 33, which comes out at £353k. You can then deduct that £353k from your required investment pot size or just simply knock £10,600 off your required income. If you’re a couple, both of whom are entitled to 100% state pension, then the numbers simply double.

To save you doing the maths for your chosen SWR % then here are the calculations at all the SWRs I’ve used in this article:

Coast FIRE and Barista FIRE

Some of you will have come across the terms Coast FIRE and Barista FIRE and may wonder why I have not mentioned them.

That’s simply because I don’t think they fit with the context of this article, they are both very different to Fat FIRE, Chubby FIRE etc.

Coast FIRE means that you have enough money invested (based on your expected returns) that you no longer need to further contribute to those savings to retire at your chosen future retirement age.

Barista FIRE follows on from Coast FIRE. Barista FIRE means taking a job that earns you less but is enough to cover your expenses (as you no longer need to save money for FIRE). This usually means going part-time or pursuing something you are more passionate about.

FIRE numbers outside of the UK

If you don’t live in the UK or you are planning on retiring to another country then you can still use the numbers in this article but you’ll need to allow for the differences in cost of living.

This website has a simple to use table https://www.worlddata.info/cost-of-living.php which shows you how the cost of living varies between countries.

Summary

Whatever labels the FIRE movement use really doesn’t matter. What matters when it comes to planning for FIRE is working out how much you realistically need/want to earn in retirement and how much you need to save to get there.

I hope this article has helped with that.

Very interesting explanation, arrived at FIRE bit late in life also but becoming more passionate about it by the day.

Glad you liked it and good luck on your FIRE journey.