Intro

Having recently switched from the Global All Cap to VWRP (FTSE All-World) due to the fee structure at my new broker. I thought I’d dig into the detailed difference for anyone else looking at which fund is right for them.

Table of Contents

What is VWRP?

To give it its full name, the Vanguard FTSE All-World UCITS ETF is an exchange-traded fund (ETF) that tracks the FTSE All-World Index. This means it comprises Large and Mid-cap stocks in Developed and Emerging markets. It does not incorporate Small Cap stocks (the key difference from the Global All Cap).

What is the Global All Cap?

The Vanguard FTSE Global All Cap Index Fund is a Fund that tracks the FTSE Global All Cap Index. It comprises Large, Mid, and Small-cap stocks in Developed and Emerging markets.

If you aren’t sure of the difference between an ETF vs a Fund, I have written a quick explainer for you.

Accumulation and Income Variants

Both the FTSE All-World UCITS ETF and the Global All Cap come in income/distribution and accumulation variants. In terms of the data in this post, there is no difference between either variant.

For clarity:

VWRL = Vanguard FTSE All-World UCITS ETF Income

VWRP = Vanguard FTSE All-World UCITS ETF Accumulation

VFGAIGI = Vanguard FTSE Global All Cap Index Fund Income

VAFTGAG = Vanguard FTSE Global All Cap Index Fund Accumulation

VWRP vs Global All Cap Summary

| VWRP | Global All Cap | |

| Type | ETF | Fund |

| Index Tracked | FTSE All-World Index | FTSE Global All Cap Index |

| Start Date | 22 May 2012 | 8 Nov 2016 |

| Number of Holdings | 3,672 | 7,129 |

| Expense Ratio (TER) | 0.22% | 0.23% |

| Fund Size | £10.9 Billion | £3.5 Billion |

| Performance (2023) | 22.03% | 14.72% |

| Dividend Yield | 1.56% | 1.61% |

VWRP/L and the Global All Cap track two different indices and one is an ETF and the other a Fund.

VWRP/L tracks the FTSE All-World Index, which comprises almost 50 countries in developed and emerging markets. It’s in the top 10 of the largest ETFs in the UK by fund size.

The Vanguard FTSE Global All Cap Index Fund also tracks developed and emerging markets but includes small-cap stocks, giving a much broader holding in terms of the number of companies held.

You can see the difference in diversification below.

Diversification

VWRP vs Global All Cap – Geography & Market Cap Weightings

| VWRP | Global All Cap | Difference | |

| Developed Markets | 92.52% | 92.59% | -0.07% |

| Emerging Markets | 7.48% | 7.41% | 0.07% |

| Large Cap | 82% | 74% | 8% |

| Mid Cap | 18% | 20% | -2% |

| Small Cap | 0% | 5% | -5% |

VWRP and the Global All Cap are very similar in terms of diversification with the notable standout of small-cap, which tilts the Global All Cap slightly away from Large Cap in comparison.

Both funds have a 62% allocation to the US.

VWRP vs Global All Cap – Sector Holdings

| Sector | VWRP | Global All Cap |

| Technology | 26.30% | 25.10% |

| Financials | 14.30% | 14.20% |

| Consumer Discretionary | 14.20% | 14.20% |

| Industrials | 13.20% | 14.00% |

| Health Care | 10.90% | 10.70% |

| Consumer Staples | 5.40% | 5.30% |

| Energy | 4.50% | 4.60% |

| Basic Materials | 3.40% | 3.60% |

| Telecommunications | 2.80% | 2.70% |

| Utilities | 2.70% | 2.70% |

| Real Estate | 2.30% | 2.80% |

As you’d expect VWRP/L and the Global All Cap are almost identical in terms of their sector weightings.

VWRP vs Global All Cap – Top10 Holdings

| Company | VWRP | Global All Cap |

| Microsoft Corp. | 4.22% | 3.77% |

| Apple Inc. | 3.66% | 3.27% |

| NVIDIA Corp. | 2.58% | 2.30% |

| Amazon.com Inc. | 2.19% | 1.95% |

| Facebook Inc. Class A | 1.49% | 1.33% |

| Alphabet Inc. Class A | 1.13% | 1.01% |

| Alphabet Inc. Class C | 0.96% | 0.86% |

| Eli Lilly & Co. | 0.87% | 0.78% |

| Broadcom Inc. | 0.77% | 0.69% |

| Tesla Inc. | 0.77% | 0.68% |

The top 10 holdings in both VWRP and the Global All Cap are the same but the Global All Cap has slightly less weighting to each (because it holds a much larger number of stocks).

Minimum Investment

Something to bear in mind if you are investing a small amount each month (<£200 ish) is that both these funds have a stock/unit price that is over £100. So if your platform does not support ‘fractional ETF’ purchases (most don’t due to the concept only recently being approved by the government) then you might be better with the Global All Cap.

Because the Global All Cap is a Fund rather than an ETF then you don’t need to worry about how much 1 unit costs because you’ll get allocated a fraction of a unit where required.

Expense Ratio

There is very little difference in cost (TER) between VWRL or VWRP and the Global All Cap fund. The TER is 0.22% and 0.23% respectively.

It’s worth mentioning that with VWRL/VWRP you also have to factor in the spread (the difference between Bid & Offer price) but because it is such a liquid share that spread is insignificant at circa 0.05%.

Trading and Liquidity

Both funds are highly liquid due to their size, but this is where the real-world difference between an ETF and a Fund will come into play.

As VWRP/L is an ETF it trades like any other share. The offer price you see on your broker’s screen is the price you’ll pay i.e. it’s real-time and your trade will happen almost instantly. So if you are selling, the proceeds will be available in your account the same day.

Because the Global All Cap is a Fund things work very differently. You won’t know your transaction price until the day after you initiated it, and if you sell you’ll have to wait a couple of days for the proceeds to appear in your account.

If you’re in the accumulation phase of FIRE and investing monthly then all of this makes little difference but it can be a little annoying to wait a few days for your money if you are selling units.

Performance & Dividends

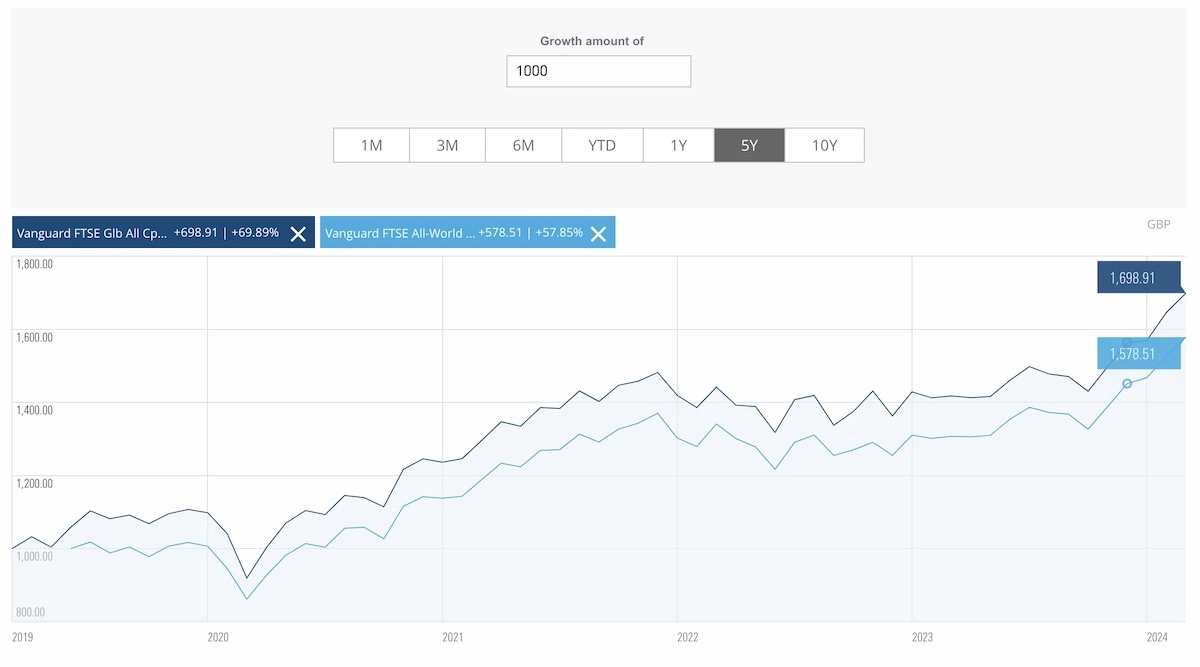

Trailing Returns

| Trailing Returns | |||

| Year | VWRP | Global All Cap | Difference |

| 3 years | 9.49% | 8.86% | 0.63% |

| 5 years | 11.25% | 10.88% | 0.37% |

| 10 years | 11.45% | N/A | |

Unfortunately, we don’t have 10 full years of performance data for the Global All Cap Fund as it hasn’t been around that long. But over a 3 and 5 year period the performance between VWRP/L and the Global All Cap is very similar with VWRP having a slight edge (because small-cap has underperformed in recent years).

I would expect the performance of both funds to be very similar going forward due to how similar they are in terms of holdings, geographic distribution etc.

Dividend Yield

| Year | VWRP | Global All Cap | Difference |

| 2023 | 2.20% | 2.07% | 0.13% |

| 2022 | 1.65% | 1.64% | 0.01% |

| 2021 | 1.82% | 1.56% | 0.26% |

| 2020 | 2.07% | 1.79% | 0.28% |

| 2019 | 2.55% | 2.33% | 0.22% |

| 2018 | 1.87% | 1.80% | 0.07% |

| 2017 | 2.43% | 1.97% | 0.46% |

You probably aren’t buying either of these funds for their dividend yield (there are funds much better suited if that’s what you are after) but the yield is pretty much identical between the two.

VWRP vs Global All Cap: Which should I choose?

Both funds are so similar that there isn’t much to choose between them and both are great funds to buy for FIRE and offer a true single fund portfolio where you don’t need to hold anything else.

That said there are some factors that would drive my decision as to which fund to hold:

If you are using a trading platform such as Hargreaves Lansdown or Fidelity, who charge significantly more for holding Funds over ETFs or your platform doesn’t offer Funds at all (Freetrade, Trading 212 etc.) then go with VWRP (or VWRL if you want the income version).

It was exactly because of this reason i.e. moving to Hargreaves Lansdown that I sold all of my Global All Cap holding and moved it to the Vanguard FTSE All-World ETF.

If your trading platform does not charge more for holding funds (Interactive Investor, iWeb etc.) and you want a truly diversified simple one fund portfolio that includes small cap. Then the Global All Cap Fund is the one for you.