In order to understand what my FIRE future looks like, so I can plan accordingly, I wanted to get a handle on what MAFF & I will get from our UK state pensions. This was actually surprisingly easy as the UK Government has a service you can log into and it tells you exactly what you will get, when you’ll get it and how many more years of National Insurance contributions you need to make.

Hang on, what does FIRE have to do with state pensions

I know some of you reading this will be wondering what on earth Financial Independence Retire Early has to do with state pensions.

Remember that I am nearly 50 years old and MAFF is 45. I have a private pension that I could take from age 55* (not that I plan on doing that).

* Note that the government are changing the Normal Minimum Pension Age on 6th April 2028, from 55 to 57, but I’m pretty sure my main private pension is protected from this.

Working out when different pension income streams kick in and how much they are worth is an important part of working out how much money I need to achieve FIRE before these dates or how much extra income I need from investments to top up those pensions.

One Big Unknown – At What Age will we receive our state pensions

Let’s get the biggest elephant in the room dealt with first. Given the perilous state of the UK’s finances, the age at which you receive your state pension is under review by the Government and it’s only going to go one way and that’s up.

Currently, the State Pension Age (the age at which you receive your state pension) is 66. If you were born after 5 April 1960, this is rising to 67 by 2028 and is scheduled to increase to age 68 between 2044 and 2046. So, currently, for anyone born after 5 April 1977, the State Pension Age will be 68.

I was born in March 1973 and MAFF was born in December 1977. So in theory I should get my state pension when I’m 67 and MAFF will get hers when she is 68.

However, there was a review carried out by the government in 2017 called ‘The Cridland review’ (because it was done by John Cridland). This proposed upping the state retirement age to 68 by 2037 (basically bringing the effective date forward from 2044). Subsequent debates have talked about this being brought even further forward to 2035 or even 2034.

Long story short, it looks highly likely that the government are going to change the age at which I get my state pension from 67 to 68.

If you’re reading this and you’re in your 30’s or younger (and in the UK) then I would assume the government are going to increase the state retirement age even further. So personally, if I were you I would assume a state retirement age of 70.

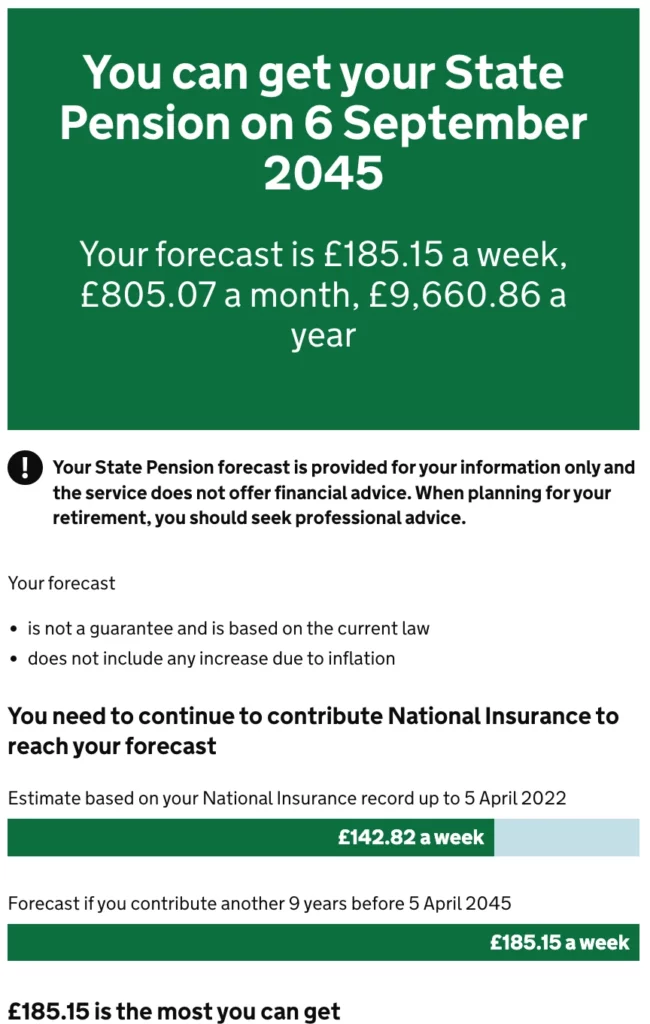

For the purposes of planning, I am going to assume a state retirement age of 68 for both of us. This means I get it from March 2041 and MAFF from September 2045.

How much is the state pension

For the current tax year (2022/23), the full State Pension is £185.15 per week or £9,627.80 per year. Paid every four weeks in arrears. Rising to £10,600 from April ’23.

The state pension is not means tested, meaning it doesn’t matter how much you earn from other income sources, you still get the state pension even if you are a multi-millionaire. Although it is subject to income tax.

However (yes there is another however warning), how well this will keep up with inflation going forwards is another thing that is subject to government debate and likely change.

Currently, there is a ‘guarantee’ in place called ‘the triple lock’. This guarantee says that the state pension amount will go up on the 6th of April each year by whichever is the higher of:

- The average percentage increase in prices (as measured by the Consumer Price Index for September of the year before)

- The average increase in wages (measured in July of the previous year)

- 2.5%

But this triple lock guarantee is another thing under threat of change.

Given there is no way of knowing the future value of the state pension, I’m just going to put it into my calculations at the current 2023 amount (because that’s guaranteed) and not make any assumptions.

Do I qualify for a UK State Pension?

To qualify for a State Pension you need to have paid what’s called National Insurance contributions. Each year of NI contributions qualifies you for 1/35th of the full state pension amount.

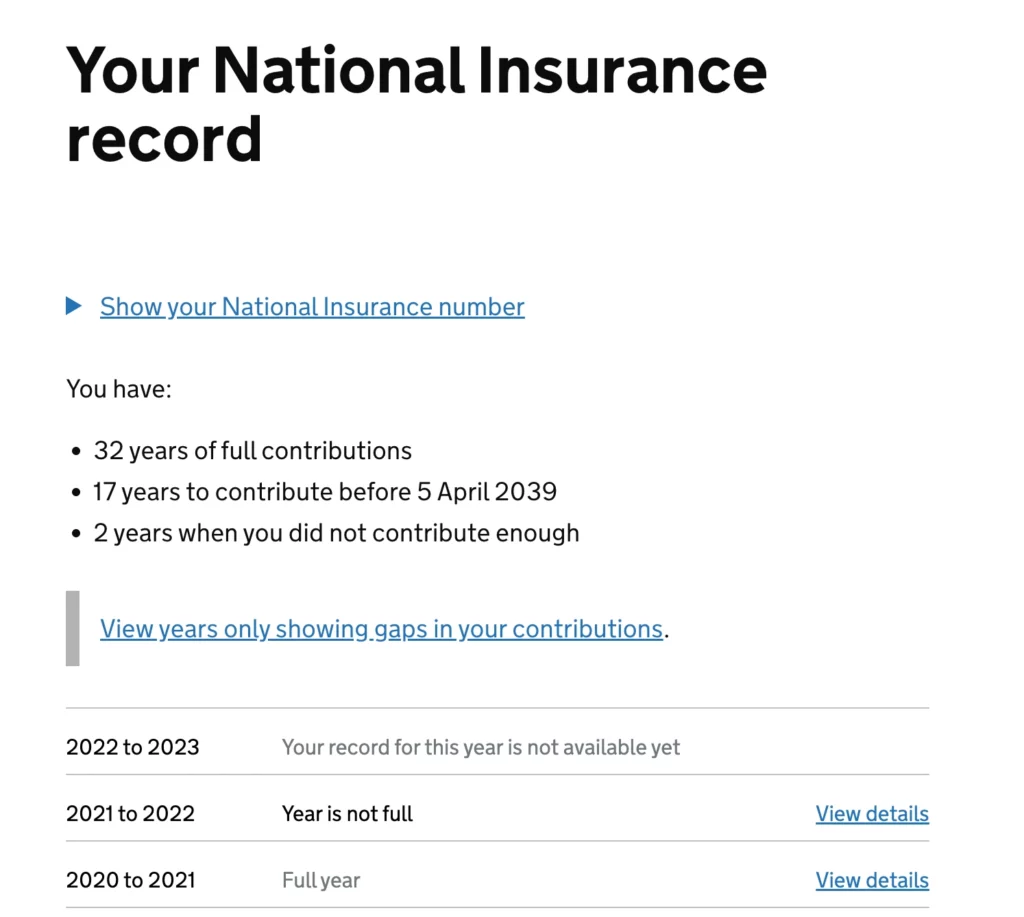

To find out how many years of national insurance contributions you have made you can sign in to your Personal Tax Account via the Government Gateway and find out.

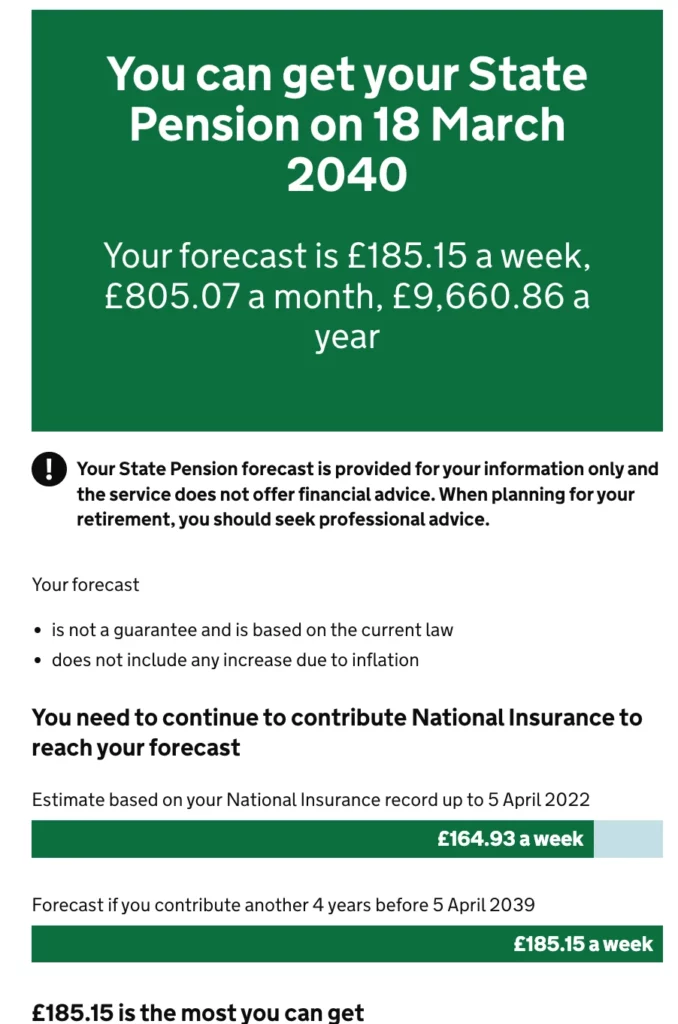

You’ll see something that looks like this

Anyone that is employed has these automatically deducted from their salary each month. If you’re self-employed or run your own company then you need to make these arrangements yourself.

You need:

- at least ten qualifying years on your National Insurance record to get any State Pension, and

- at least 35 qualifying years to receive a full State Pension

The good news is that both MAFF & I have made these contributions for most of our working lives. I started paying NI when I was only 16 years old because I had a part-time job and I only have 1 year of missed payments since then.

I only have 3 more years worth of contributions to pay to qualify for a full state pension and MAFF has 8 years of payments to make. I just need to make sure that we make these payments each year.

I think I’m safe, for my planning purposes, to assume we will both get the full state pension.

FAQs

Is the UK State pension a Good Investment

Depending on your circumstances, you may wonder if it is worth paying your National Insurance contributions (you don’t have to pay them unless you are an employee earning over a certain amount). Or you may have a shortfall in your contributions and wondering if it’s worth making back payments (you can make up to 6 years of back payments to catch up with missed contributions).

I used to work in the pensions industry and I remember people were rather shocked when they found out the answer to this one, so I thought I’d highlight it.

The best way to think about it is this. How much money would I need to generate a guaranteed £10k per year in retirement (basically matching the state pension). If you use an annuity calculator like this one you’ll discover that you’d need roughly £200k.

So a full UK state pension is worth approximately £200,000.

Is the UK State Pension Enough to Retire On

Depending on which source you use for the stats, between one in three to one in five people in the UK plan to depend solely on the state pension for income in retirement.

Don’t be one of them is all I’ve got to say, I’m certainly not planning on it. If you do end up with only a state pension to your name, you do get additional welfare payments but it would be a pretty miserly existence.

Can I defer my State Pension

Yes, you can defer your state pension. I took these figures directly from the government website.

For every 9 weeks you defer taking your state pension, it goes up by 1%. That’s just under 5.8% per year.