I have decided to take a look at my current trading platform costs to see if I can get a cheaper one without compromising on quality of service/range of services or safety.

So is there a better or best trading platform in the UK for larger accounts? By ‘larger’ I talking investments of circa £250k and upwards. I spent a good few hours researching the most likely candidates, so let’s see.

My Requirements

- I hold both ETFs (Shares) & OEIC’s (Funds)

- I have funds/ETFs from a range of different providers

- I have two accounts, one for me and one for MAFF

- We both have a SIPP an ISA and a GIA

- I am currently buying monthly on an automated basis but this will stop soon

- I would like a better set of tools for portfolio performance and analysis than my current platform offers.

Non-Requirements

For readers who stumble across this article, who are not familiar with this blog or FIRE, I should clarify a few points. When looking for the best trading platform, I am not talking about day trading, crypto, CFDs or anything along those lines.

What most FIRE types want is a trading platform that handles; ISA’s, SIPPs & GIAs. Offers index-tracking ETFs and Funds, bonds, shares etc. Facilities like automated monthly investments, dividend reinvestment etc. So if this isn’t you, you’re in the wrong place.

Other Considerations – Safety

The FSCS (Financial Services Compensation Scheme) covers you for losses up to £85k per person, per company and all the companies in this article fall under that scheme. Importantly, the FSCS also only covers you for cash holdings in your account and from malpractice by the trading platform.

For those of us with larger pots, that £85k limit doesn’t offer much comfort. And, even if you are under that amount and technically covered (within the limitations mentioned), I’d imagine the pain, time and anguish of actually getting your money back would be long and worrying.

Compiling this article has made me seriously think about this and a few other things. So from a safety perspective, my thoughts are this:

Splitting Investments up amongst a couple of Trading Platforms

Whilst I think the real risk of loss is small, I still remember all too well the Financial crisis of 2008. The lesson from that is that even the unimaginable is possible.

So I’m definitely going to split our accounts across a couple of providers (it’s already split across a number of fund managers). Whilst I’m not going to go so far as to not exceed £85k per company, that would be unmanageable, 2 or 3 would be fine.

The Size of the companies behind the trading platforms

Most of the trading platforms covered in the article are owned by large to very large companies, but Trading 212 and FreeTrade are Fintech startups.

Trading 212 in particular looks ‘interesting’ given it appears the company is registered in Cyprus and Bulgaria.

Whilst I’m all for startups disrupting the staid and uncompetitive world of financial services, I’m not so keen to risk having lots of my money sitting with one. So I’m going to avoid those types of companies.

Summary

Jon you weirdo, why are you putting the summary mid-way through your article?

Well, I’m assuming a lot of readers will skim this article, look at who they are with now and look at who’s cheaper using the pricing table. But there are a couple of key points I want people to realise, so I’m putting them here where you’re more likely to see them.

The best trading platform for you will vary based on a number of factors:

Do you hold Funds?

It came as a bit of a shock to me just how much some brokers are charging for Funds compared to ETFs and it can make a massive difference (we’re talking thousands of pounds of difference if your Fund holdings are sizeable!!). If you hold Funds then Hargreaves Lansdown, AJ Bell & Fidelity will charge you handsomely for it and Freetrade & Trading 212 don’t even offer Funds at all.

Given how popular the Vanguard FTSE Global All Cap Index Fund is in the FIRE community, this could be an issue for a lot of us.

The good news is that there are plenty of low-cost trading platforms that don’t differentiate between Funds and shares but it does limit your choice considerably.

Are you automatically investing monthly?

Some brokers don’t offer automated monthly investments at all, some charge for it and some are free.

Do you trade regularly?

Again costs vary significantly, from free to £11.95 per trade.

Are you close to the age where you can access your SIPP?

If you are nearing pension access age (currently 55) then watch out for extra hidden fees, a number of platforms charge an extra annual fee for drawdown or uncrystallised funds pension lump sum.

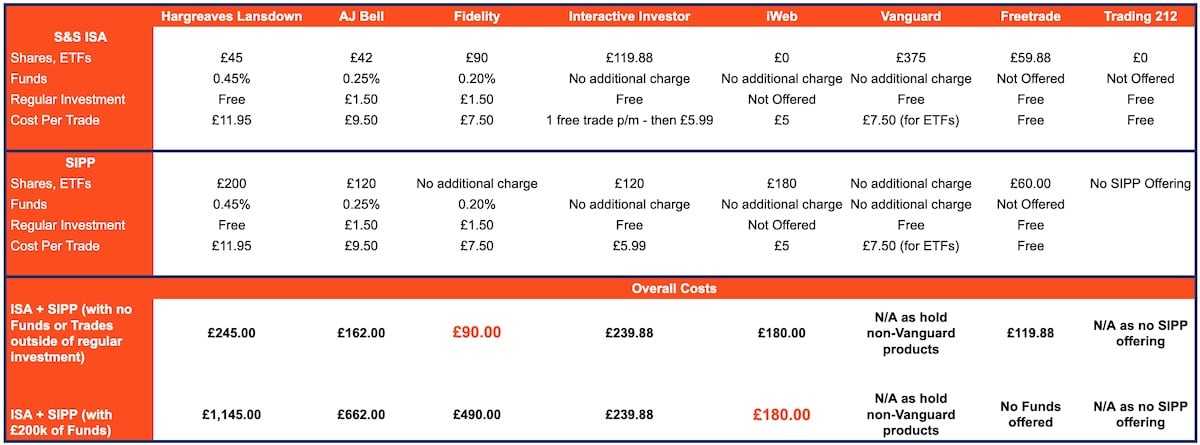

Trading Platform Comparison Table

| Hargreaves Lansdown | AJ Bell | Fidelity | Interactive Investor | IWeb | Vanguard | Freetrade | Trading 212 | |

|---|---|---|---|---|---|---|---|---|

| S&S ISA | ||||||||

| Shares, ETFs | £45 | £42 | £90 | £119.88 | £0 | £375 | £59.88 | £0 |

| Funds | 0.45% | 0.25% | 0.20% | No additional charge | No additional charge | No additional charge | Not Offered | Not Offered |

| Regular Investment | Free | £1.50 | £1.50 | Free | Not Offered | Free | Free | Free |

| Cost Per Trade | £11.95 | £9.50 | £7.50 | 1 free trade p/m - then £5.99 | £5 | £7.50 (for ETFs) | Free | Free |

| SIPP | ||||||||

| Shares, ETFs | £200 | £120 | No additional charge | £120 | £180 | No additional charge | £60.00 | No SIPP Offering |

| Funds | 0.45% | 0.25% | 0.20% | No additional charge | No additional charge | No additional charge | Not Offered | |

| Regular Investment | Free | £1.50 | £1.50 | Free | Not Offered | Free | Free | |

| Cost Per Trade | £11.95 | £9.50 | £7.50 | £5.99 | £5 | £7.50 (for ETFs) | Free | |

Overall Costs | ||||||||

| ISA + SIPP (with no Funds or Trades outside of regular investment) | £245.00 | £162.00 | £90.00 | £239.88 | £180.00 | N/A as hold non-Vanguard products | £119.88 | N/A as no SIPP offering |

| ISA + SIPP (with £200k of Funds) | £1,145.00 | £662.00 | £490.00 | £239.88 | £180.00 | N/A as hold non-Vanguard products | No Funds offered | N/A as no SIPP offering |

If you want a more detailed and comprehensive broker comparison table then take a look at https://monevator.com/compare-uk-cheapest-online-brokers . I have only covered the ones I was interested in, not the whole market.

I also came across this tool online https://mymoneyuk.netlify.app/platform-fees which, whilst currently quite basic, allows you to input your situation and it gives you a personalised cost comparison for a few of the main trading platforms.

My Current Trading Platform

Both accounts (MAFF & I) are with Interactive Investor. The customer service and the platform itself are very good and the mobile app, which is what I mainly use, allows me to do everything I need.

It costs me £19.99 per month, per account. So that’s a total of £479.76 per year, for both accounts combined. I’ll break their fees down in more detail later in this article.

The only minor annoyance I have is that there is no concept of a ‘family account’ so I have one account for me and one account for MAFF and I have to log in to each separately.

Trading Platforms I have immediately ruled out

Vanguard

Vanguard charges 0.15% per year as a platform fee (this covers ISA, SIPP & GIA), capped at £375 per year for accounts over £250,000. So for two accounts combined that would cost me £750 per year. Which is more than I currently pay.

The other issue is you can only hold Vanguard funds, which not all of mine are.

So for those two reasons, Vanguard are ruled out.

Trading 212

I’ve heard mixed things about Trading 212 in terms of customer service. Their platform is actually free as are trades, so that makes them rather tough to beat on the costs front. They also offer fractional holdings i.e. you can buy less than 1 whole share.

But they don’t offer SIPPs and they only have ETFs & Shares on their platform. You can’t buy funds and given on of my largest holdings is Vanguard Global All Cap Index Fund, then that’s a problem.

If you only want an S&S ISA or GIA and only want to hold ETFs or shares then definitely check them out as you can’t beat the price. Just be wary of their customer service.

For me, however, they’re also out due to the lack of SIPPs and funds.

Best Trading Account UK

So let’s now look at the contenders for the best trading account for larger amounts in the UK and whether or not I can save money.

Interactive Investor (owned by Abrdn)

As mentioned, this is who I’m currently with but I’ll detail their fee structure etc. here in case you want to look them over.

Interactive Investor’s fee structure is also one of the more complicated ones, so I’d urge you to take a look at their fees page for yourself but here’s how they break it down:

S&S ISA

If you have £30k or less then it starts at £4.99 per month + £5.99 per trade (regular monthly investing is free)

If you have over £30k then you pay £9.99 per month and get one free trade per month (again regular monthly investing is free)

There is then a final plan at £19.99 per month for frequent traders. You get two free trades per month and any additional trades are reduced to £3.99.

SIPP

If you just want a SIPP (not an S&S ISA) then it’s £12.99 per month. If you want both a SIPP & an S&S ISA then both combined cost £19.99 per month. Trading fees are again £5.99 per trade. One thing to note is that you don’t get any free trades on the SIPP but, again, regular monthly investing is free.

In terms of quality of service, they are good. The mobile app is good. The platform has plenty of features but the charting and the level of portfolio performance analysis you can do is lacking (so I do all of this in a spreadsheet).

The Contenders

Hargreaves Lansdown

Hargreaves Lansdown has a good reputation in terms of quality of service but as you’ll see from below you have to be very careful that their fee structure works for your circumstances. They can work out very cheap or very expensive.

Hargreaves Lansdown has the most complicated fee structure of all the trading platforms I looked at. To work out what they will cost you, you’ll need to look at the website (find their fees pages, which are somewhat buried), find out which tier of fee structure you fall into and then get a spreadsheet out.

To save you some spreadsheet work. If you only want an ISA, only hold ETFs or Shares and don’t trade outside of your regular monthly investment then they are cheap (not quite the cheapest but very close). If you hold Funds then forget it, they are the most expensive of the platforms I reviewed.

For ISA accounts between £250,000 – £1m they charge 0.45% on the first £250k and 0.25% on the remainder (i.e. £250k-1m) per annum for ‘Funds’. For shares, ETFs, Investment Trusts etc. the charges are the same but crucially they are capped at £45 per year.

There is no fee for buying and selling funds but buying and selling ETFs would cost me £11.95 per trade.

For SIPP accounts the charges for Funds are the same as the ISA but for Shares, ETFs etc. it’s capped at an increased level of £200. And again £11.95 per trade.

So by my rough maths, for both accounts combined again, Hargreaves Lansdown would cost me a whopping £2,537 per year. Yep, that’s not a typo, that’s over five times the cost of Interactive Investor!

To be fair to Hargreaves Lansdown, if I only held ETFs and I very rarely traded (maybe once or twice a year) the costs would be significantly more palatable at around £520 per year (but still more than I pay now).

Their fees for Funds are way out of line with the market and this is what makes them so expensive for me.

I had to get a spreadsheet out to work out how much I had in Funds vs ETFs, in which accounts and how many times a year I am currently trading just to get an idea of what it would actually cost me.

So that’s Hargreaves Lansdown out of the picture by a country mile.

iWeb (owned by Lloyds Bank)

iWeb charges a one-off account opening fee of £100 (although they have an offer on at the moment where you get £100 cashback for transferring an account to them worth over £5k).

There is no ongoing fee for a S&S ISA but they charge £45 per quarter for SIPPs worth over £50,000 (so £180 per year per account). Trades are £5 per trade and they don’t offer regular monthly investing for free.

For some people, this looks like a good deal, but for me it doesn’t work out.

In my case, that means it would cost me £360 per year for two SIPP accounts, which is cheaper than II, but I do about 8 regular monthly trades which would be an additional £480 per year. So at £840 per year, they would be more expensive for me.

In addition, I know from people that use iWeb that the platform is outdated and not very functional.

Fidelity

Fidelity is another one that has a fairly complicated tiered fee structure with caps on ETFs, Shares etc. but not Funds.

ETFs & Shares are capped at £90 per year. For Funds between £250k – £1m the fee is 0.20%.

In addition, they charge £1.50 for each trade that is part of a regular monthly investment and £7.50 for all other trades.

When you work all of this out, if it wasn’t for the fact that I hold some funds (not just ETFs & Shares). Then it would only cost me £90 per account + a relatively small amount in dealing fees (say another £100 per year). That comes out at £380 per year for both accounts combined.

Unfortunately for me, I do hold one fund so our actual fees would be more like £780 per year combined.

AJ Bell

S&S ISA

AJ Bell charges a capped fee of £42 p/a for Shares (inc ETFs etc) and 0.25% for the first £250k of Funds (dropping to 0.01% between £250-500k and 0% after that).

There is then a charge of £1.50 per regular monthly trade and £9.50 for Shares outside of this.

SIPP

A capped fee of £120 p/a for Shares and the same fees as per their ISA for Funds and dealing charges.

Again it is my Fund holdings that make this not work for me. Without the Fund issue that would put my AJ Bell fees at £324 per year combined + approx £100 in dealing fees. But the Funds bumped that right up by another £500 per year.

FreeTrade

For S&S ISA only FreeTrade offer a flat fee of £59.88 per year, if you want a SIPP & ISA then it’s £119.88 combined. There are no trading fees.

Bargain, but once again they only offer Shares, ETFs etc. and not Funds, so it’s not right for me.

Conclusion

So after all of that, what am I going to do?

For now, I’m going to stick with Interactive Investor whilst I’m busily reorganising my portfolio as I discussed in my FIRE Portfolio post.

For the rest of this year, I will be exiting a number of positions I hold and no longer want and rapidly reinvesting the money into my target portfolio. Whilst all of this is going on, Interactive Investor is probably my cheapest option particularly whilst I hold Funds and because I get free monthly trades, free monthly investments etc.

In February/March next year, when that reorganisation is over and everything is stable I will look to move some or all of my accounts. This is both to save on costs and spread my risk amongst providers.

Fidelity looks to be the best choice for MAFFs account (she doesn’t hold any Funds) as they have a good reputation and are 1/3 of the cost I’m currently paying at £90 per year.

For my ISA I might move that to Hargreaves Lansdown (£45 p/a) and leave my SIPP with Interactive Investor (as it’s my SIPP that contains the Fund). That would save me money and spread our risk amongst three different large providers.

Conveniently, it also coincides with the end of the tax year when a lot of the trading platforms offer cashback incentives (one user on Reddit told me that Hargreaves Lansdown paid him £5k to move his account to them. That would cover their costs for years).

Have you thought about ditching your funds altogether? There isn’t a lot out there that you cannot replicate with ETFs, and ditching them would help you save probably half of your current fees (that’s what I pay, with a slightly larger portfolio).

Re: spreading risk around several brokers, as an example what I do is keep ISA & SIPP with Fidelity (to save on fees), then S&S LISA with AJBell (nothing cheaper around for this one, to the best of my knowledge), a GIA with Freetrade – which is actually free if you avoid anything involving FX (like trading US stocks), and another GIA with IBKR to actually trade US Stocks and options.

This gives me 4 different brokers – which should be enough in terms of platform diversification.

Hi – yes, I have definitely considered ditching the one fund I hold (Vanguard Global All Cap) from my SIPP. If I decide to move away from Interactive Investor to a platform, such as Fidelity, which charges me extra for holding funds then I will change it to VWRP with maybe a small percentage in a global small cap ETF to give me the same spread as the Global All Cap.

In terms of spreading risk amongst different brokers then I think this is also on the cards, I’ll probably split it between two or three.

My plan at the moment is to wait until March 2024 and see what sort of offers the different platforms come out with, as aware that around the new tax year quite a few offer some decent cashback incentives for transferring.

Thank you for taking the time to comment and sorry it has taken me so long to spot it sitting in the system and reply to you. Best of luck with your FIRE journey.